are political contributions tax deductible irs

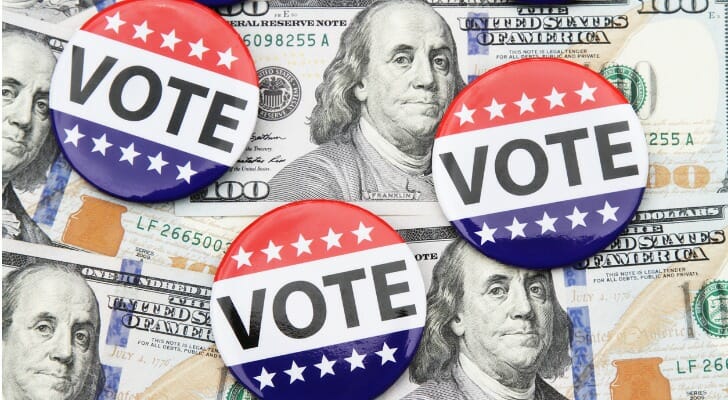

If youre planning to donate money time or effort to a political campaign you might be thinking to yourself Are political contributions tax-deductible No. 501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious.

Do I Qualify For New 300 Tax Deduction Under The Cares Act

If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the.

. IRS Provides Tax Inflation Adjustments for Tax Year. A 501c3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States CodeIt is one of the 29 types of 501c nonprofit organizations in the US. Religious and charitable organizations typically fall under section 501c3 and can receive tax-deductible donations.

If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method. Article Sources Investopedia requires writers to use primary sources to support.

Each group must register with the IRS for the section of the law that applies to it. For tax purposes the law classifies charities and nonprofits according to their mission and organizational structure. Political Campaign Activity by section 501c3 tax-exempt organizations Under the Internal Revenue Code all section 501c3 organizations are absolutely prohibited from directly or indirectly participating in or intervening in any political campaign on behalf of or in opposition to any candidate for elective public office.

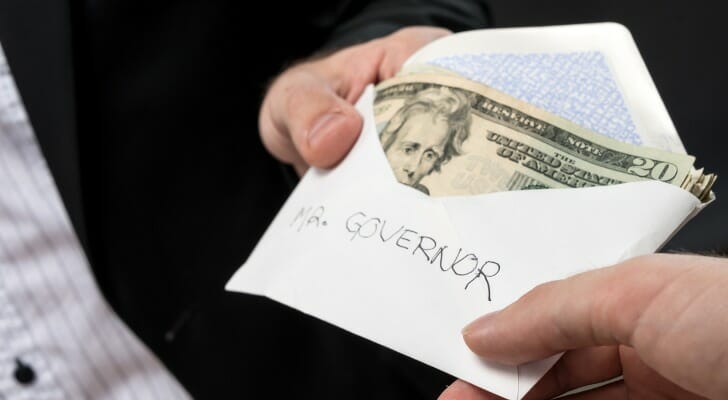

The following list offers some examples of what the IRS says is not. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Say your business has 100000 in taxable income for example but it gives away a tax-deductible gift worth 10000.

Meanwhile pre-tax contributions as with traditional 401k plans help reduce income tax during your working years. Tax-deductible gifts are those that can be subtracted from your income. Publication 969 Health Savings Accounts and Other Tax-Favored Health Plans Pages 5-7.

The Internal Revenue Code IRC in section 6033e imposes reporting and notice requirements on certain tax-exempt organizations described in sections 501c4 501c5 and 501c6 that incur nondeductible lobbying and political expensesOrganizations that do not provide notices of amounts of membership dues allocable to nondeductible lobbying. Internal Revenue Service. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method.

The answer ultimately depends on the type of gift the recipient and whether it was given by a business or an individual.

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Smartasset

Are Contributions To A Political Organization Tax Deductible Universal Cpa Review

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Why Political Contributions Are Not Tax Deductible

Are Political Donations Tax Deductible Credit Karma Tax

Charitable Deductions On Your Tax Return Cash And Gifts

Are Political Contributions Tax Deductible Smartasset

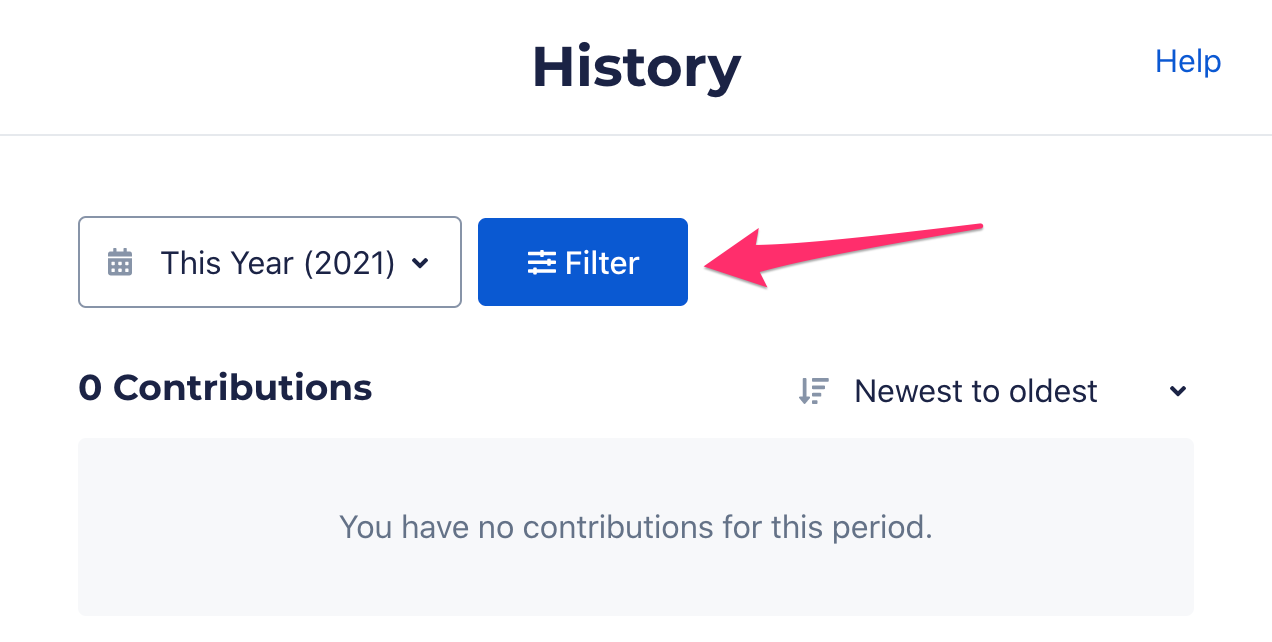

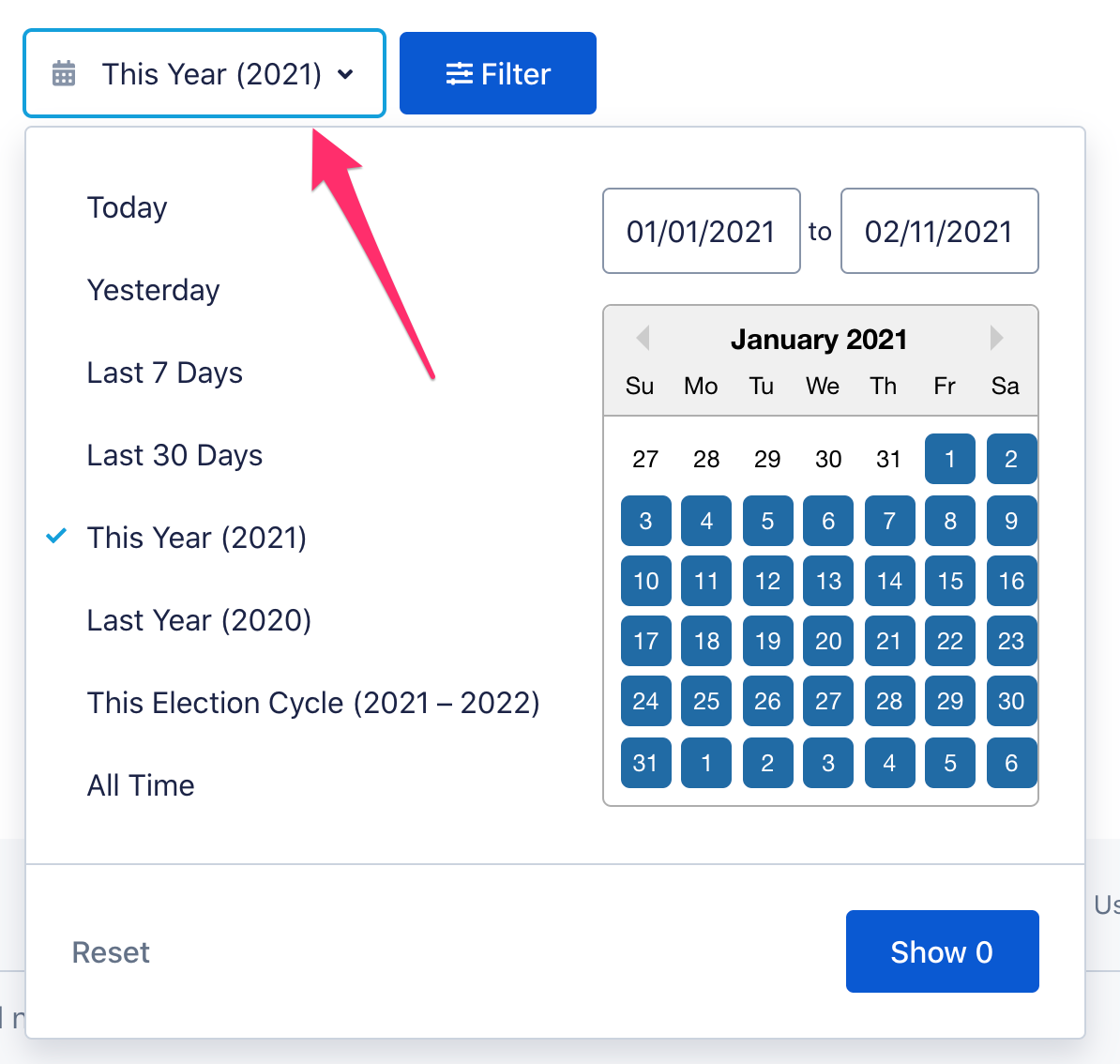

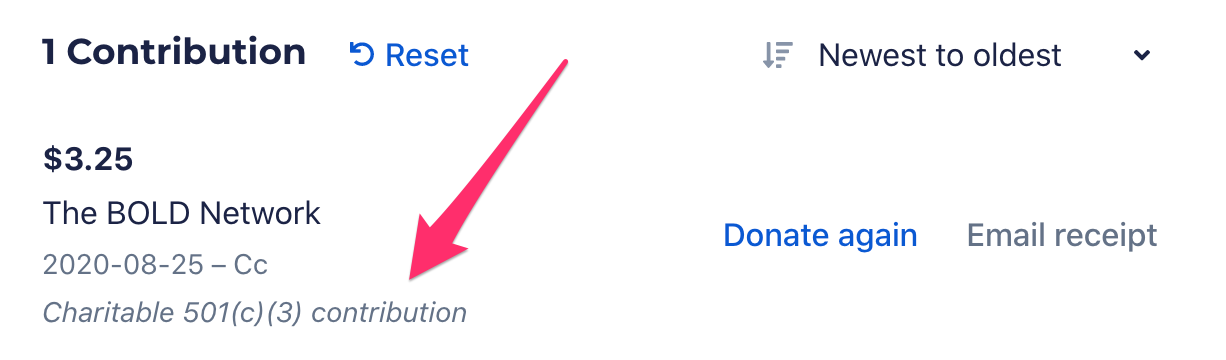

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Smartasset

Are My Donations Tax Deductible Actblue Support

Are Your Political Contributions Tax Deductible Taxact Blog

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Tax Breaks Explained

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping